Revenue Division PO Box 630 Santa Fe, New Mexico 87509 State of New Mexico Taxation and Revenue Dept.

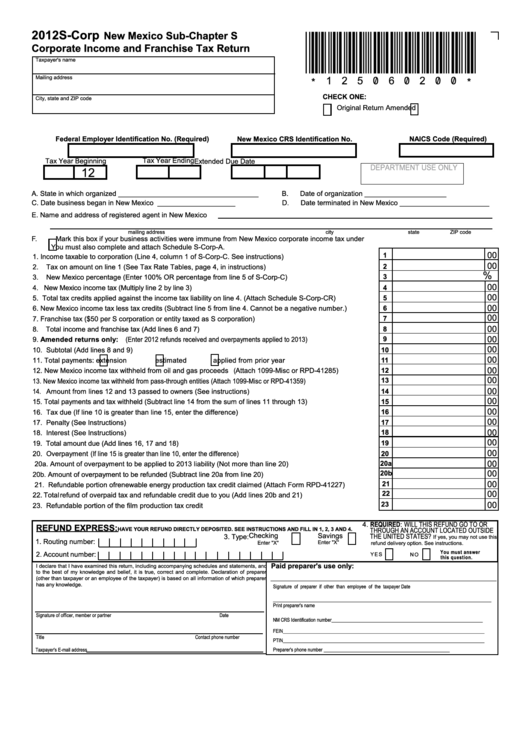

(c) The Contractor shall submit applications for Nontaxable Transaction Certificates, FormCSR-3 C, to the: The allowability of any gross receipts taxes or local option taxes lawfully paid to the State of New Mexico by the Contractor or its subcontractors will be determined in accordance with the Allowable Cost and Payment clause of this contract except as provided in paragraph (d) of this clause. (b) The Contractor shall pay the New Mexico gross receipts taxes, pursuant to the Gross Receipts and Compensating Tax Act of New Mexico, assessed against the contract fee and costs paid for performance of this contract, or of any part or portion thereof, within the State of New Mexico. (a) Within thirty (30) days after award of this contract, the Contractor shall advise the State of New Mexico of this contract by registering with the State of New Mexico, Taxation and Revenue Department, Revenue Division, pursuant to the Tax Administration Act of the State of New Mexico and shall identify the contract number. State of New Mexico Gross Receipts and Compensating Tax (Apr 2003) We are here to help.As prescribed in 29.401-4(b), insert the following clause: If you would like more information about how this change may apply to your business, contact us. While there is no requirement for sellers to collect the New Mexico gross receipts tax or compensating tax from the customer, the seller must provide a general statement that the New Mexico gross receipts tax is included in the price of the good or service, if the tax is not separately stated on the customer invoice. New Mexico also updated the requirements related to how sellers state the gross receipts tax on their invoices. New Mexico has an economic nexus threshold of $100,000 in sales made during the previous calendar year.

Nexus can be established with New Mexico through physical presence or economic nexus. As of July 1, 2021, taxpayers must pay state and local rates for most goods and certain services based on the customer’s New Mexico location. The change impacts both in-state and out-of-state sellers. Under the change, if an out-of-state seller ships a taxable item to a customer in New Mexico, the compensating tax, including New Mexico state and local taxes, would be sourced to the customer’s location. For example, in-person services, including medical services, physical therapy, home health care, and services provided by barbers and cosmetologists, will now be sourced to the location of the service.Ĭhanges to the sourcing of the state’s compensating tax mirror those made to the gross receipts tax. Most goods and certain services subject to New Mexico gross receipts or compensating tax will now be sourced to the location where the product or service is provided. New Mexico recently changed the reporting location for its gross receipts tax and compensating tax to destination-based sourcing for most goods and certain services.

0 kommentar(er)

0 kommentar(er)